The EBITDA is a measure of a NVIDIA Corporation's overall financial performance and is widely used to measure a its profitability. NVIDIA Corporation's EBITDA (earnings before interest, taxes, depreciation and amortisation) is $10.7 billion.

By accounting for growth, it could also help you if you're comparing the share prices of multiple high-growth companies. The PEG ratio provides a broader view than just the P/E ratio, as it gives more insight into NVIDIA Corporation's future profitability. A low ratio can be interpreted as meaning the shares offer better value, while a higher ratio can be interpreted as meaning the shares offer worse value. NVIDIA Corporation's "price/earnings-to-growth ratio" can be calculated by dividing its P/E ratio by its growth – to give 2.7326. The high P/E ratio could mean that investors are optimistic about the outlook for the shares or simply that they're over-valued. That's relatively high compared to, say, the trailing 12-month P/E ratio for the NASDAQ 100 at the end of 2019 (27.29). In other words, NVIDIA Corporation shares trade at around 39x recent earnings. NVIDIA Corporation's current share price divided by its per-share earnings (EPS) over a 12-month period gives a "trailing price/earnings ratio" of roughly 39x. However, analysts commonly use some key metrics to help gauge the value of a stock.

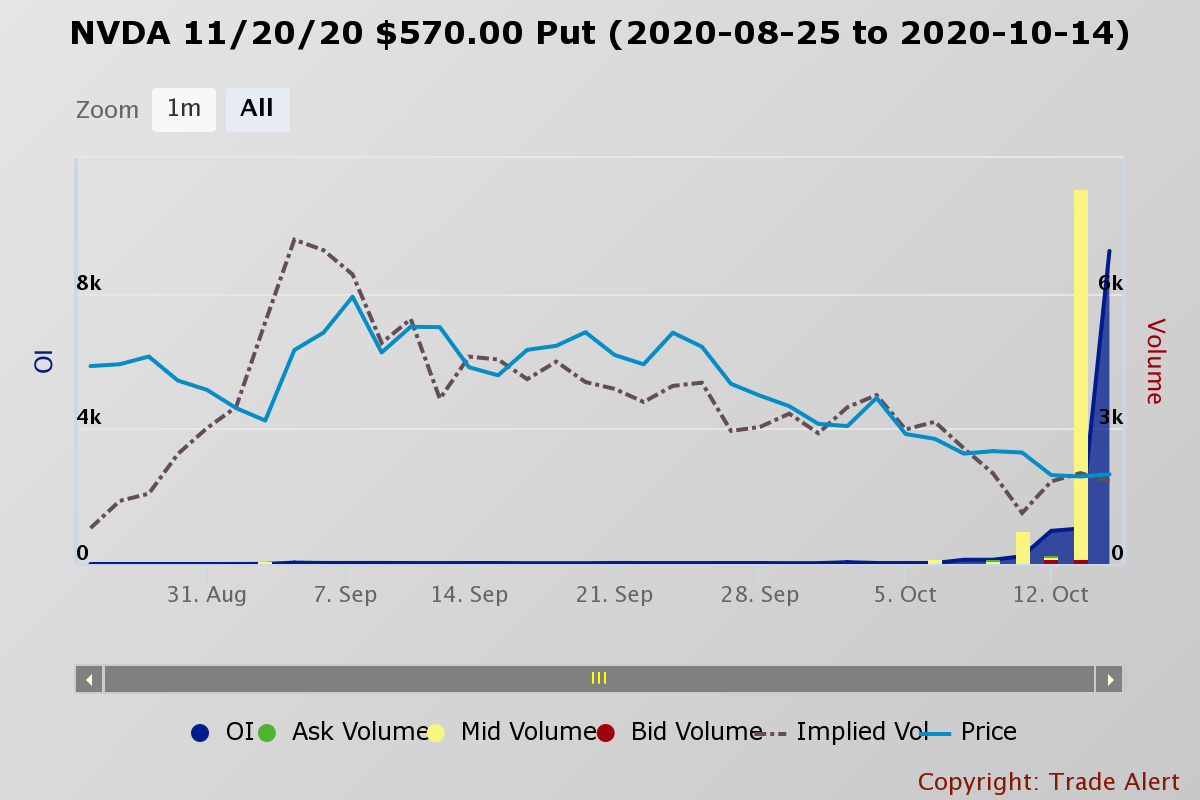

Valuing NVIDIA Corporation stock is incredibly difficult, and any metric has to be viewed as part of a bigger picture of NVIDIA Corporation's overall performance. Is NVIDIA Corporation stock undervalued or overvalued? Use our graph to track the performance of NVDA stocks over time. NVIDIA Corporation stock price (NASDAQ: NVDA) If you had bought $1,000 worth of NVIDIA Corporation shares at the start of February 2020, those shares would have been worth $884.79 at the bottom of the March crash, and if you held on to them, then as of the last market close they'd be worth $607.44. Its last close price was $146.02, which is 50.35% down on its pre-crash value of $294.07 and 23.74% down on the lowest point reached during the March crash when the shares fell as low as $180.68. Since the stock market crash in March caused by coronavirus, NVIDIA Corporation's share price has had significant negative movement. How has coronavirus impacted NVIDIA Corporation's share price?

0 kommentar(er)

0 kommentar(er)